WEEKLY EDITION

March 25, 2021

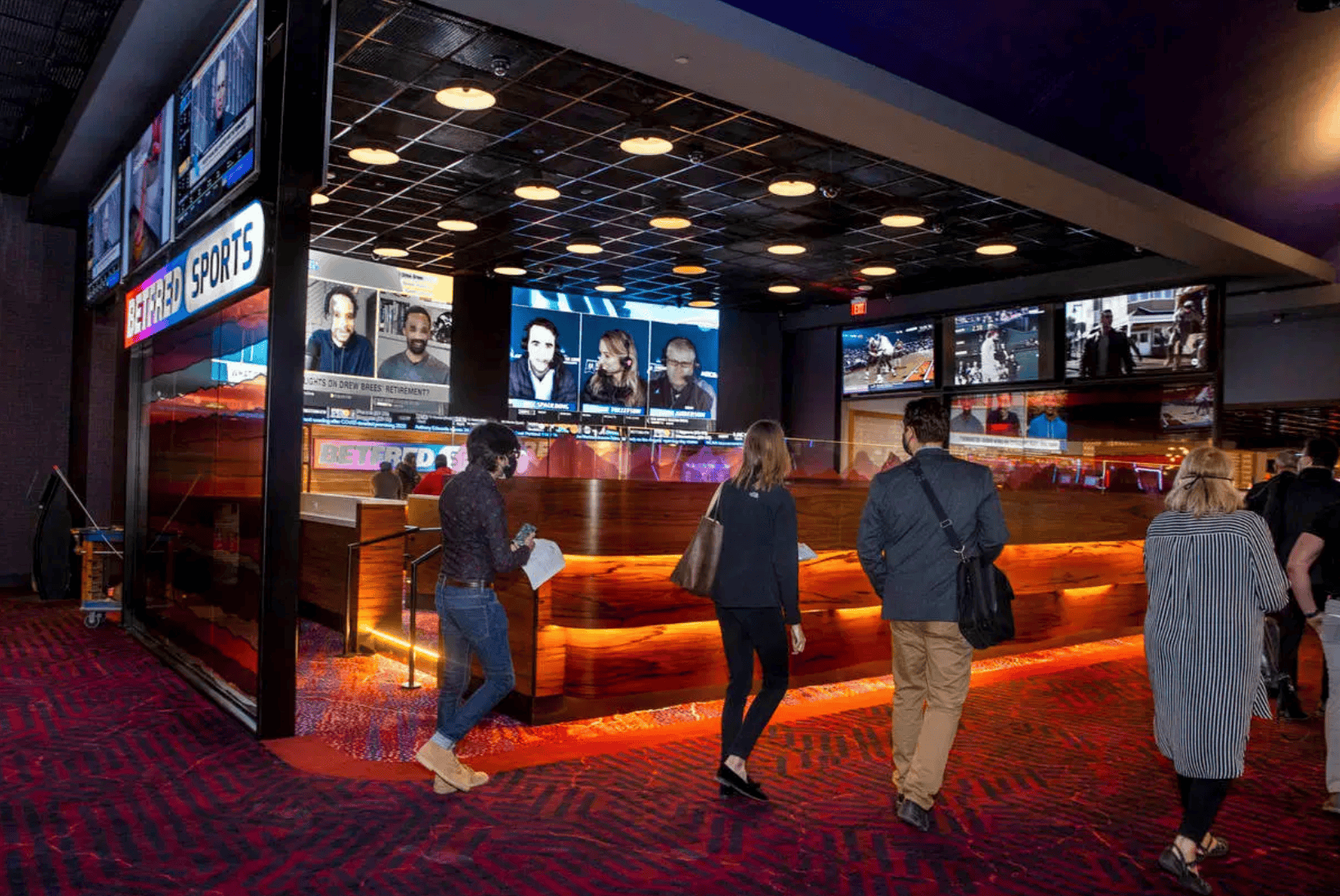

Congratulations to Betfred USA Sports and Mohegan Gaming & Entertainment on the grand opening of Virgin Hotels Las Vegas!

This new property joins its sister properties, Ilani, Ridgefield, WA; Paragon Casino Resort, Marksville, LA; Resorts Casino Hotel, Atlantic City, NJ; Mohegan Sun Pocono, Wilkes-Barre, PA; Fallsville Resort Hotel and Casino Niagra, Niagra Falls, Ontario; and their flagship property, Mohegan Sun in Uncasville, CT.

An article in the Las Vegas Review Journal provides the following “By the Numbers” for the new Virgin Hotels Las Vegas:

- 2,000 — Number of Virgin team members, with 1,600 set to work opening week and 400 joining later once the “backyard area” opens

- 650 — Number of slot machines on the casino floor

- 44 — Number of table games on the casino floor

- 60,000 — Square footage of the casino floor, operated by the Mohegan Sun tribe

- 130,000 — Amount of square footage for meeting space, known as The Manor

- 10,000 — Approximate number of people that can attend events at The Manor

- 1,500 — Number of hotel rooms and suites in three towers

- $0 — Amount charged in resort fees and for parking

- 5 — Acres of swimming pool area

- 4,500 — Capacity of hotel’s entertainment theater

- 415 — Number of days between the closure of the Hard Rock Hotel and the planned opening of Virgin Hotels Las Vegas

The Evolution of the Value of Sports Data

In Storytelling, it’s better to center on great characters rather than concepts. Why write about rocketry when you have Elon Musk? Would you rather hear about consumer supply chain logistics or Amazon? A 400-word piece on Sports Data, or Sportradar?

Once upon a time, in 2001, Petter Fornass and Tore Steinkjer wrote a program that trawled the web for betting odds published on the internet by sportsbooks.

Totally Unrelated Sidenote: Did you read the feature article in newsletter volume 31, “Do you Really Know Who or What Drives your Website Traffic?“, where we write about, among other things, the oldest form of internet bot, the Scraper? It’s pretty good stuff.

Fifteen years later, we find Sportradar with exclusive rights to distribute NASCAR, NHL, and the National Football League. They not only became partners through a long-term deal but became equity owners in their subsidiary company, Sportradar US. Next, in 2016, the NBA partnered with Sportradar data services, including video streaming.

At this point, Sportradar’s limited definition as a provider of feeds for sportsbook odds and sports data is far in the rearview mirror. The company has evolved from its original Knowledge and Comprehension-based data sources. It provides Analysis, Synthesis, and Evaluation in the forms of Real-time mathematical models for evaluating risk for sportsbooks, including in-play wagering odds and Match-fixing detection systems.

What does this comprehensive embrace of sports data and development of value add services from raw data mean for companies like Sportsradar? Sports leagues see the immense value of sports data, especially its new offerings in the Analysis, Synthesis, and Evaluation of the raw data. They are securing deals with new agreements which recognize that value, accordingly.

- The NFL currently has a data agreement with Sportradar and has equity in the firm from a deal dating back to 2015.

- The NFL expanded its current data deal with Sportradar in 2019. The contract covers data collection and operations for the NFL’s next-generation stats using Amazon Web Services (AWS). They are already discussing an extension.

- CNBC reports that the NFL “..could seek up to $250 million per year in its next data distribution contract.”

- The NFL and Sportradar expanded their partnership in 2019 to include audiovisual game feeds to select international markets and integrity services.

- The company also extended its deal with the National Basketball Association last October. Under its previous contract, it paid the NBA about $41 million per year.

In 2020, with only 20 states having legal sports betting, the US reported over USD 21B in handle and USD 1.5B in revenue. Sportsbook operators are in the middle of a massive land grab for footprint, licenses, and customers.

Simultaneously, in the realm of intellectual property licensing and data, sports leagues, operators, venues, cable, television, and OTT broadcasters fight to secure value-add partnerships to ensure they can reach the scale necessary to survive in the markets to come.

Would you like to talk about how we can help you be part of the winners in the sports wagering markets of the future? We’re ready to talk — take a look below.

Related Client Partners

Liked the article? Check out our related Client Partners below.

- Betfred Sports is a turnkey provider for brick and mortar, online and mobile sports wagering and iGaming.

- Sporting Solutions provides modular sports betting solutions for pricing, risk management, analytics and tooling for sports book operators who want to outsource parts of their business.

- Metric Gaming‘s multi-tenant cloud-based sportsbook platform.

- Picklebet is a full featured online esports betting platform.

- Betswap technology enables sports books to provide a secondary marketplace for their customers to sell or buy bets no longer available at the sportsbook.

- Netacea provides bot detection and mitigation for web, mobile and APIs

- LSports provides real-time sports data solutions to provide valuable performance insight.

- Triggy provides B2B solutions for live score messaging and personalization.

- Oddin provides the largest and most available source of esports data.

- Golden Race uses realistic odds data to provide virtual sports outcomes that reflect real player and team performance.

WELCOME TO YOUR ROUNDUP OF EUROPEAN IGAMING NEWS

Our European weekly iGaming feature article summarizes the thoughts of Jake Pollard, an experienced journalist and editor who has covered the online gaming and betting industry for many years. He has written for the leading media outlets as well as operators and suppliers in the igaming space. His areas of focus are wide-ranging and include regulatory developments in the US, emerging markets in South America and how European countries are adapting to a decade of igaming regulation.

UK Gambling Commission CEO resigns in the wake of Football Index Scandal

On the regulatory front, the week’s biggest news has been the resignation of Neil McArthur, CEO of the UK Gambling Commission. The move comes at a susceptible time for the biggest regulated iGaming market in Europe. The Gambling Act review currently underway could lead to a significant regulatory overhaul of UK operators’ working environment, with the potential introduction of measures like affordability checks and advertising restrictions. The scandal that engulfed the firm Football Index was the final straw that brought an end to McArthur’s tenure, although the UKGC denies this. Operators’ legal and compliance teams might also breathe a sigh of relief at his departure; they regularly complained that the Commission was challenging to deal with regardless of the matter raised. However, that will also depend on who replaces him. More to the point, his near-constant focus on responsible gambling and combative stance towards the industry meant he missed other critical matters which required nuance and a willingness to listen to a broad range of views. Football Index was the most glaring and final example of this attitude.

Bally’s-Gamesys Deal Shows the Importance of iGaming

On the business side of things, the biggest news of the week has been the acquisition of UK iGaming operator Gamesys by Bally’s for US$2.8bn. It’s another huge deal that sees a UK operator cross the waters to chase its destiny in the U.S. Gamesys is home to some of the sharpest minds in the business when it comes to online casino marketing and retention. The two firms’ rationale makes sense. Combining the Gamesys expertise with Bally’s land-based casino presence in 11 states, its betWorks sportsbook technology, SportCaller free-to-play games, and Monkey Knife Fight fantasy betting makes for a significant player in the US iGaming space. It’s a big move by Bally’s. However, as one analyst noted, the fact that “Gamesys CEO Lee Fenton will be group CEO while Bally’s CEO George Papanier takes a more limited retail role for core land-based casino business” shows how vital iGaming now is in the US.

Retail to Online Shift in Italy

A Gambling Compliance report on European gambling activity during the pandemic revealed that Italy had provided “the clearest example of retail to online channel shift” in the region. Overall, online GGR grew 45% to €2.6bn in 2020 as lockdowns hit in Q3 and Q4 in particular. Online casino handle grew 46% to €1.2bn, online betting was up 37.5% to nearly €1bn, offsetting a 33% drop in retail betting GGR to €581m. Interestingly, Entain, which runs Eurobet across retail and online (and BetMGM in the US), said the arrival of retail players to online led to improved margins thanks to their fondness for parlay bets.

SCCG Management: New and Upcoming Events

STEPHEN CRYSTAL TRAVELING TO ARIZONA AND CALIFORNIA

Stephen Crystal in the process of planning and scheduling travel to Arizona and California, where he will be meeting with clients and partners in the next month.

If you are interested in reaching out to Stephen Crystal regarding these trips, please contact him directly at stephen.crystal@sccgmanagement.com.

B. Riley Securities Sports Betting & iGaming Conference

Stephen Crystal will be participating in a panel discussion for the B. Riley Securities Sports Betting and iGaming Conference on March 29, 2021. Be on the lookout for more information on this conference as it is released.

Gaming Americas Meetups

Stephen Crystal will be participating in a panel discussion for the GA2QM Virtual Conference on April 29, 2021. Be on the lookout for more information on this conference as it is released.

SCCG Management and Nevatronix Bring Transformational…

News Provided by SCCG Management Tuesday, March 16, 2021, 6:00 AM Pacific Time Stephen Crystal of SCCG and Ara Tcholakian of Nevatronix announce a partnership to bring transformational sports betting devices to US Sportsbooks. Las Vegas, NV,…

Read more

staging.sccg.devel8.wlc.team